The Council has increased its Council Tax by £6.11 for the 2025/26 financial year which equates to an increase of 2.99% bringing the annual charge to £210.65 for a Band D property.

There continues to be significant financial pressures on the Council for 2025/26 and beyond. The Council is responding to these pressures through its Fit for the Future programme which is designed to deliver additional income and savings that will balance the budget over the medium term. In the interim the Council will use its reserves to best safeguard the essential services it delivers.

Council Tax per Household

| Band | 2024/25 | 2025/26 | Increase |

|---|---|---|---|

| A | £136.36 | £140.43 | £4.07 |

| B | £159.09 | £163.84 | £4.75 |

| C | £181.81 | £187.24 | £5.43 |

| D | £204.54 | £210.65 | £6.11 |

| E | £249.99 | £257.46 | £7.47 |

| F | £295.45 | £304.27 | £8.82 |

| G | £340.90 | £351.08 | £10.18 |

| H | £409.08 | £421.30 | £12.22 |

The Total Band D Council Tax is:

| Authority | Amount |

|---|---|

| ESCC | £1,867.05 |

| Rother District Council | £210.65 |

| Sussex Police Authority | £266.91 |

| East Sussex Fire Authority | £112.49 |

| Parish/Town Council | See the table below for each area’s amount |

Town Council Expenditures

Battle Town Council 2025/26

| Area | Gross Expenditure £ | Income £ | Net Expenditure £ |

|---|---|---|---|

| Finance and General Purpose | 397,332 | -30,411 | 366,921 |

| Environment | 135,272 | -46,230 | 89,042 |

| External Relations and Town Development | 22,420 | -1,000 | 21,420 |

| Planning and Transport | 21,418 | 0 | 21,418 |

| Town Council Precept | 576,442 | -77,641 | 498,801 |

| 2024/25 Total | 547,182 | -71,912 | 475,270 |

Rye Town Council 2025/26

| Area | 2024/25 £ | 2025/26 £ |

|---|---|---|

| Affordable Accommodation | 13,669 | 8,669 |

| Devolved Services | 22,000 | 50,544 |

| General Administration | 160,609 | 156,116 |

| Grants/Donations/Loans | 2,500 | 7,000 |

| Property Purchase and Maintenance | 8,650 | 9,850 |

| Public Realm | 85,070 | 84,226 |

| Recreation | 23,325 | 37,850 |

| Tourism | 1,000 | 3,075 |

| Gross Expenditure | 316,823 | 357,330 |

| Income | -66,136 | -72,447 |

| Town Council Precept | 250,687 | 284,883 |

Bexhill on Sea Town Council 2025/26

| Area | 2024/25 £ | 2025/26 £ |

|---|---|---|

| Central Support | 369,335 | 498,100 |

| Premises and Equipment Costs | 61,000 | 84,700 |

| Bus Shelters | 0 | 10,000 |

| Community Committee | 58,000 | 78,000 |

| Climate, Nature and Environment Committee | 46,809 | 48,500 |

| Member Representation | 45,500 | 25,750 |

| Allotments | 4,650 | 5,650 |

| Other Costs | 24,500 | 15,000 |

| Reserves | 50,000 | 50,000 |

| Public Toilets | 0 | 42,000 |

| CCTV | 55,000 | 37,000 |

| Christmas Lights | 32,000 | 65,000 |

| Gross Expenditure | 746,794 | 959,700 |

| Income | -33,630 | -42,260 |

| Town Council Precept | 713,164 | 917,440 |

Council Tax Amounts in each Area 2025/26

| 2024/25 Local Precept £ | Local Tax Area | 2025/26 Local Precept £ | 2025/26 Local Band D Council Tax £ | 2025/26 Total Band D Council Tax £ |

|---|---|---|---|---|

| 14,500 | Ashburnham & Penhurst | 15,225 | 74.50 | 2,531.60 |

| 475,270 | Battle | 498,801 | 171.77 | 2,628.87 |

| 25,000 | Beckley | 30,000 | 52.75 | 2,509.85 |

| 1,424,720 | Bexhill (see note) | 1,649,544 | 95.24 | 2,552.34 |

| 15,209 | Bodiam | 15,670 | 91.30 | 2,548.40 |

| 41,686 | Brede | 44,117 | 49.91 | 2,507.01 |

| 8,460 | Brightling | 9,137 | 43.91 | 2,501.01 |

| 113,198 | Burwash | 113,198 | 87.05 | 2,544.15 |

| 63,498 | Camber | 63,498 | 88.76 | 2,545.86 |

| 32,000 | Catsfield | 48,400 | 124.59 | 2,581.69 |

| 35,218 | Crowhurst | 35,217 | 92.91 | 2,550.01 |

| 11,000 | Dallington | 11,500 | 62.26 | 2,519.36 |

| 0 | East Guldeford | 0 | 0.00 | 2,457.10 |

| 82,000 | Etchingham | 87,500 | 200.93 | 2,658.03 |

| 80,437 | Ewhurst | 83,122 | 145.22 | 2,602.32 |

| 95,000 | Fairlight | 74,867 | 80.18 | 2,537.28 |

| 9,977 | Guestling | 10,326 | 15.44 | 2,472.54 |

| 56,784 | Hurst Green | 65,818 | 110.65 | 2,567.75 |

| 166,730 | Icklesham | 151,110 | 115.71 | 2,572.81 |

| 16,000 | Iden | 18,000 | 73.42 | 2,530.52 |

| 12,000 | Mountfield | 12,000 | 56.83 | 2,513.93 |

| 113,000 | Northiam | 134,000 | 122.31 | 2,579.41 |

| 37,000 | Peasmarsh | 37,000 | 70.01 | 2,527.11 |

| 26,000 | Pett | 35,000 | 71.71 | 2,528.81 |

| 5,000 | Playden | 5,000 | 28.32 | 2,485.42 |

| 325,761 | Rye (see note) | 364,525 | 184.68 | 2,641.78 |

| 2,500 | Rye Foreign | 2,500 | 14.00 | 2,471.10 |

| 129,287 | Salehurst | 152,820 | 148.13 | 2,605.23 |

| 67,650 | Sedlescombe | 70,000 | 101.58 | 2,558.68 |

| 159,110 | Ticehurst | 163,179 | 91.18 | 2,548.28 |

| 7,000 | Udimore | 7,000 | 35.89 | 2,492.99 |

| 111,000 | Westfield | 118,770 | 103.27 | 2,560.37 |

| 7,455 | Whatlington | 8,200 | 50.80 | 2,507.90 |

| Note | Local Precept 2025/26 | 2024/25 | Rother Expenses 2025/26 | 2024/25 |

|---|---|---|---|---|

| Bexhill: | £917,440 | £713,164 | £732,104 | £711,556 |

| Rye: | £284,883 | £250,687 | £79,642 | £75,074 |

Spending on Services

2024/25

| Area | 2024/25 Net Budget £000 |

|---|---|

| Chief Executive | 3,170 |

| Deputy Chief Executive | 4,860 |

| Director Place and Climate Change | 7,335 |

| Total Cost of Services | 15,365 |

| Other Operating Income and Expenditure | -66 |

| Total Rother District Council Budget | 15,299 |

| Local Council Budgets | 2,983 |

| Gross Budget Requirements | 18,282 |

2025/26

| Area | Gross Spend £000 | Income £000 | Net Spend £000 |

|---|---|---|---|

| Chief Executive Officer (HoPS) | 4,259 | -3,335 | 924 |

| Deputy Chief Executive Officer (s151) | 32,099 | -23,812 | 8,287 |

| Director of Governance and Community Services (MO) | 14,934 | -8,429 | 6,505 |

| Total Cost of Services | 51,292 | -35,576 | 15,716 |

| Other Operating Income and Expenditure | 1,514 | -1,214 | 300 |

| Total Rother District Council Budget | 52,806 | -36,790 | 16,016 |

| Local Council Budgets | 3,323 | 0 | 3,323 |

| Gross Budget Requirements | 56,129 | -36,790 | 19,339 |

How Spending Changed

| Increase/(-Decrease) in Year on Year Spend | £000 |

|---|---|

| Rother District Council Cost of Services 2024/25 | 15,365 |

| Temporary accommodation costs (net) | 431 |

| Temporary accommodation purchases – cost recovery | -104 |

| Extended Producer Responsibility for Packaging (EPR) grant | -955 |

| Grounds maintenance contract savings (net) | -179 |

| Public conveniences cleaning contract saving (net) | -71 |

| Car park charges (net) | -117 |

| Property voids and rent reviews | 161 |

| Finance – Asset valuations, licence and external audit fees, bank charges, system upgrades and increase in unapportioned pension costs | 131 |

| Planning Development Management – net additional income from planning fees, charges and recharges, offset by new posts to enhance service provision | -213 |

| Waste contract increases and food waste collection preparation costs | 469 |

| Employer’s national insurance increase | 260 |

| Other miscellaneous changes | 538 |

| Rother District Council Cost of Services 2025/26 | 15,716 |

Spending on Capital Projects

2025/26

| Area | Capital Projects £000 |

|---|---|

| Development Programme | 24,512 |

| A Thriving Local Economy | 3,055 |

| Live Well Locally | 9,377 |

| Fit for the future | 502 |

| Green to the Core | 70 |

| Total Rother District Council Capital Budget | 37,516 |

Where the Money Comes From

| Source | £000 | £ per resident | % |

|---|---|---|---|

| Income | 2,028 | 21 | 10 |

| Business Rate Retention Scheme | 4,816 | 51 | 25 |

| Council Taxpayers (including Parishes) | 12,495 | 132 | 65 |

| Gross Budget Requirement | 19,339 | 204 | 100 |

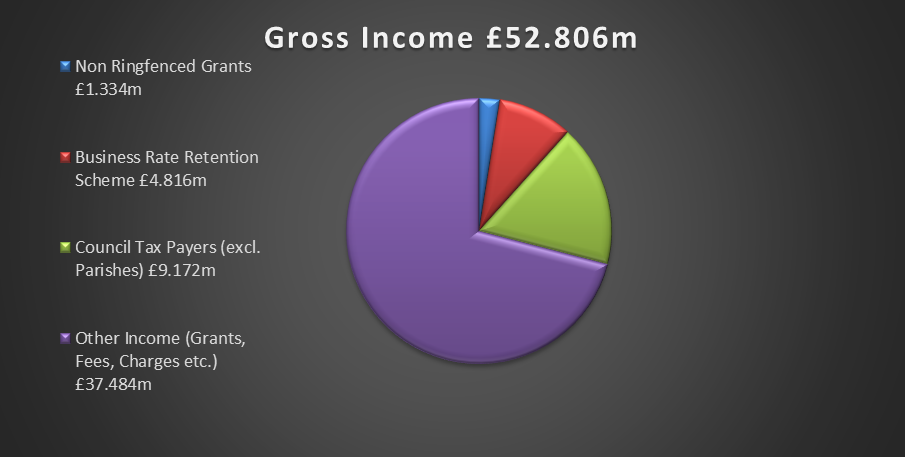

Who Funds Us?

Only a small portion of our services and projects are paid for through Council Tax, the majority of our funding comes from other sources.

The gross income pie chart below shows the breakdown of where we get our money from.

Other Information

The budget requirement includes levies from the following:-

| Levies From | 2025/26 Amount | 2024/25 Amount |

|---|---|---|

| Romney Marshes Area Internal Drainage Board | £159,025 | £154,354 |

| Pevensey and Cuckmere Water Level Management Board | £5,536 | £5,199 |

The number of staff to be employed by the Council in 2025/26 is estimated to be 268 full time equivalents. There is an increase of 15 from 2024/25. A number of posts are funded by external sources and capital schemes.

National Fraud Initiative – Fair Processing Notice

The Council is required by law to protect the public funds it administers. It may share information provided to it with other bodies responsible for auditing or administering public funds in order to prevent and detect fraud. The Cabinet Office currently requires us to participate in its anti-fraud initiative.

At present there are two data matching exercises;

- A two-yearly national match to government, local government and other public sector records for which we supply payroll, housing benefit, council tax reduction scheme, creditors, licensing and housing register data; and

- An annual local match of council tax and electoral register data.

The use of data by the Cabinet Office in data matching exercises is carried out with statutory authority under Part 6 of the Local Audit and Accountability Act 2014. It does not require the consent of the individuals concerned under the General Data Protection Regulation (GDPR) and Data Protection Act 2018.

Further information is available on our website at www.rother.gov.uk.